You are here

Home Blogs Nicholas Winton's blogIs a resurgent INK Canadian Insider Index ready to leap to new highs?

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

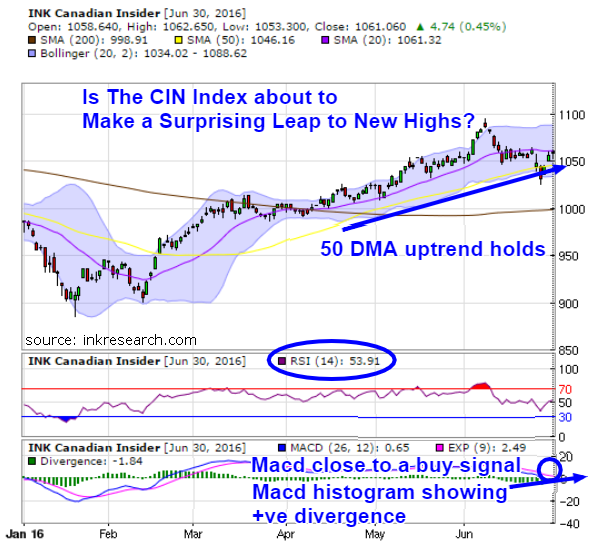

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. In our June 24th update, we remarked that the Index bore barely a scratch (a mere 5-point drop) when world indices tumbled as much as 6% during the preceding week. Last week, the CIN Index once again demonstrated its resilience as it fought back from a heavy 1.6% decline on June 27th to end the week at 1061.06, up 13 points or 1.2% in holiday-shortened trading.

The chart of the Index is at a key juncture, for it finds itself just below its 20-day moving average of 1061.32 which now becomes a new resistance level. Above that, the next major resistance is at 1079. Now, the Index did in fact fall below its key 20-day moving average (and 1050 support level) last week and plunged even further, to its lower support of 1026 (actually, 0.6 below that) before rocketing 35 points higher.

It's important we highlight this major price reversal because a chart that plunges below a major support which then reverses and closes with a gain is seen as triggering a bullish technical buy signal. Indeed, when investors are shaken or stopped out of their positions by a decline below a defined support, and then are stunned by a large rebound, sidelined traders are often forced to chase and re-buy their positions at higher and higher prices.

Exciting as the prospect for a major turnaround may be, the resumption of the CIN Index's bullish multi-month trend requires the Index to confidently clear its 20-day moving average which has capped its progress since June 14th. This week, the Index's first support is at 1046.16 where its 50-day moving average sits, and, below that, its next support is at 1026.

There is positive news to report on the momentum front. RSI soared 40.5% from a low of 38.36 into the low 50s (53.91 to be exact). Based on past evidence, RSI will most likely need to return to the 60s for the Index to break through resistance and move higher.

Our slower moving momentum measure MACD briefly found itself in negative territory (-0.32) for the first time since late February, before reversing trend and closing the week at 0.65. The Index's MACD histogram clearly shows positive divergence, as it stops declining and begins climbing after mid-June (even as the Index was under pressure), and did a good job of foreshadowing the Index's rebound. Momentum-wise, the Index needs to see a crossover of the fast MACD blue line over the slow red line for the bullish case to win out, and this is a distinct possibility, as the two lines remain just a hair apart.

With all that said, since the CIN Index has weathered the recent financial storm and displayed such terrific relative strength in doing so, I wouldn't bet against a further increase and a return to its bullish multi-month uptrend before too long.

Nike shoes | Nike Air Max 270 - Deine Größe bis zu 70% günstiger

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.