You are here

Home Blogs Nicholas Winton's blogRaising the Roof: INK CIN Index Vaults to 7-Week High

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

Technical Overview by Nicholas Winton, Hedgehog Trader and @HedgehogTrader on Twitter

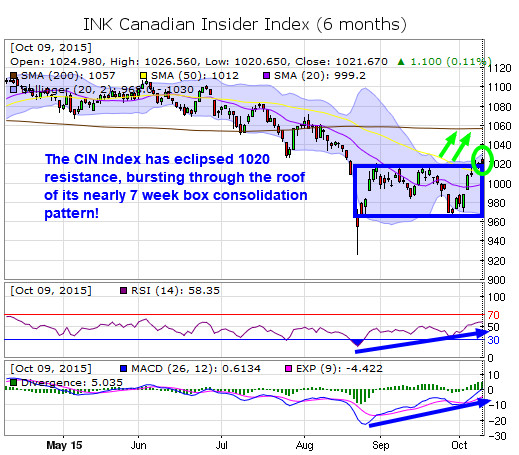

Thank you for joining us for our weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. In our last update, we suggested the Index was buying itself time to build momentum when it pulled back to its 960 base and expanded its box consolidation pattern.

Indeed, what seemed a scary step backward ultimately generated forward movement for the Index, when it powerfully spring-boarded from its 960 support straight up to the roof of its box pattern. And on Friday, the CIN Index quietly closed a hair above 1020. This is a bullish development because although the index has reached the 1020 level a few times in the past 7 weeks, it failed to close above this line in the sand each time.

In an equally bullish turn of events, the Index's Relative Strength Indicator (RSI) was finally able to accelerate and surpass the 50 level (now 58), indicating momentum has now risen to its highest levels in nearly two months.

Current support levels of the INK Canadian Insider (CIN) Index are 1000 and 1020. Looking ahead, the next overhead target and major resistance is around 1060 (or 4% higher), which marks its 200 day moving average.

Best Nike Sneakers | Nike nike air max paris 1 patch 2017 , Sneakers , Ietp STORE

Category:

- Please sign in or create an account to leave comments

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.