You are here

Home Blogs INK Staff's blogWhen central planning options shrink

Ad blocking detected

Thank you for visiting CanadianInsider.com. We have detected you cannot see ads being served on our site due to blocking. Unfortunately, due to the high cost of data, we cannot serve the requested page without the accompanied ads.

If you have installed ad-blocking software, please disable it (sometimes a complete uninstall is necessary). Private browsing Firefox users should be able to disable tracking protection while visiting our website. Visit Mozilla support for more information. If you do not believe you have any ad-blocking software on your browser, you may want to try another browser, computer or internet service provider. Alternatively, you may consider the following if you want an ad-free experience.

* Price is subject to applicable taxes.

Paid subscriptions and memberships are auto-renewing unless cancelled (easily done via the Account Settings Membership Status page after logging in). Once cancelled, a subscription or membership will terminate at the end of the current term.

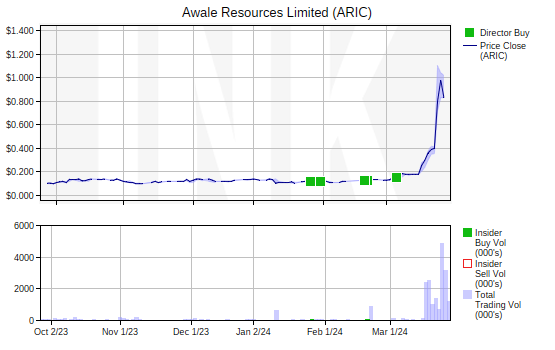

From the March INK Top 20 Mining & Crypto Report - Gold continues to advance even as the Federal Reserve drags its feet on cutting rates. Even copper has managed to make progress, poking above US$4.00/lb. The defiance of these two major metals even as US interest rates remain high has led to some spectacular moves among some junior mining names.

Awale Resources (ARIC) debuts in the Top 20 at #17

This raises the question of how gold and copper and some juniors can be doing so well even as we hear remarkable bravado from Fed officials that interest rates are likely to stay higher for longer.

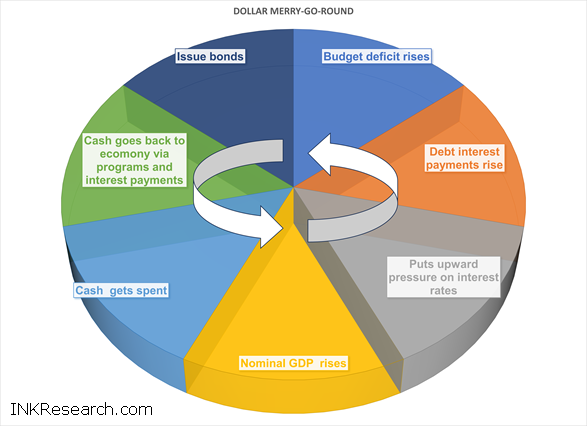

For example, on March 27th Forexlive reported that FOMC member Christopher Waller said, "if unemployment goes up no reason to panic." Mr. Waller may want investors to believe that more unemployment is okay, but gold is clearly calling his bluff. The way we see it, the Fed has been lucky so far thanks to the magnificent deficit spending by Washington which has helped to keep nominal growth high. The dollar merry-go-round which we described in our January Top 20 has kept spinning. That has allowed the Fed to keep its July 2023 rate hike in place as the economy has yet to roll over in real terms, and the banking system has only had minor and manageable tremors as seen at New York Community Bank (Mixed; NYCB) this winter.

The dollar merry-go-round from the January INK Top 20

However, gold is telling us that the merry-go-round music will likely stop soon. The Fed will be squeezed between its desire to keep rates high to deal with its previous policy blunder of keeping monetary policy too loose for too long and the reality that the banking system, parts of the economy, and the US budget cannot handle the Fed's current rate policy.

We only have to look across the Pacific at Japan to see what happens when policymakers get squeezed. The Bank of Japan is indeed on the other side of the policy world from the Fed where the Bank of Japan is reluctant to raise rates because it professes to be concerned about inflation not being strong enough. On the ground, however, inflation is squeezing the average Japanese citizen whether it be via outright higher prices or shrinkflation where consumer products companies try to hide price increases by reducing the size of product packages while keeping prices more or less constant.

Bank of Japan options are shrinking

As prices of products and services have moved up, the popularity of the Kishida government has dropped to new lows. As we write this report, it is the Bank of Japan's policy options are shrinking as it will likely have to choose between raising rates more aggressively to support the yen to help contain imported inflation, or risk handing Fumio Kishida more inflation via a weakening currency. Meanwhile, the Fed's options are also shrinking. It either has to cut rates soon or risk something in the economy breaking in the lead-up to the November election. Gold seems to sense what the decision will be.

Cryptocurrencies are also showing strength. How much of the recent move relates to the same factors driving gold remains to be seen. We will have a better sense of the sustainability of the rally once the bitcoin halving expected in early April takes place. The halving is the point in time where rewards to bitcoin miners are cut in half thereby reducing the creation rate of new bitcoins. In terms of our crypto-equity rankings, we see newcomer Bitcoin Well (Sunny; BTCW) has taken the top spot. The company is focused on expanding bitcoin usability. Generally, we believe plenty of work still needs to be done to drive cryptocurrency adoption among consumers who still prefer to use legacy payment systems.

This is an excerpt from the March INK Edge Top 20 Mining & Crypto Equities Report. The entire report including the 20-top ranked INK Edge mining stocks and 5-top crypto-equities is available for members of inkresearch.com and Canadianinsider.com. Join Canadian Insider for C$45.45 (+tax) per month. Learn more here.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out or underperform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ#3 at inkresearch.com.

Category:

Please make the indicated changes including the new text: US quotes snapshot data provided by IEX. Additional price data and company information powered by Twelve Data.